如何填写美国的W8(W-8BEN-E)纳税表格

关注微信公众号

关注微信公众号

- 13004647955

- 客服

这个W8我填了很多次了,第一次是用香港的名义去填的,第二次是大陆公司名字填的,每次都是付款前老外教我怎么填,第一次是老外的业务员教我填的,随便乱写也没关系,他也付款成功,第二次是老外财务教我填写的,正规了很多,所以我就把最终这个模板贡献出来给大家参考,反正只要能付款成功就是对的,其他都是浮云啊。各位要记住你第一次填了以后,这个模板可能就失效了【Once these changes are made, the form will be valid. 】原话:When the form is downloaded the information entered disappears, they need to print the form and complete it.】,让老外重新发模板给你,重新填吧。

为什么老外一定要填W8-BEN-E呢?因为他们中国供应商的货款对他们来说是一笔支出,支出越多,税就少了,说白了可以抵消税务,老外原话: I heard our tax department is helping get the paperwork settled.美国人不可能抽中国人的税,W-8BEN-E填了就是说这个意思,假如客户让你填W-8BEN-E你填吗??假如不填的话美国人不会和你做生意,美国很多中大型公司做生意,特别是大一点的规范公司,W-8BEN-E必须要的一个关卡,很多顾客在没订单的情况下,一来就让我们填写,我一般是不接受的,因为假如第一次填写基本你要填30-60分钟。只有确定订单以前我们可以填写一下。

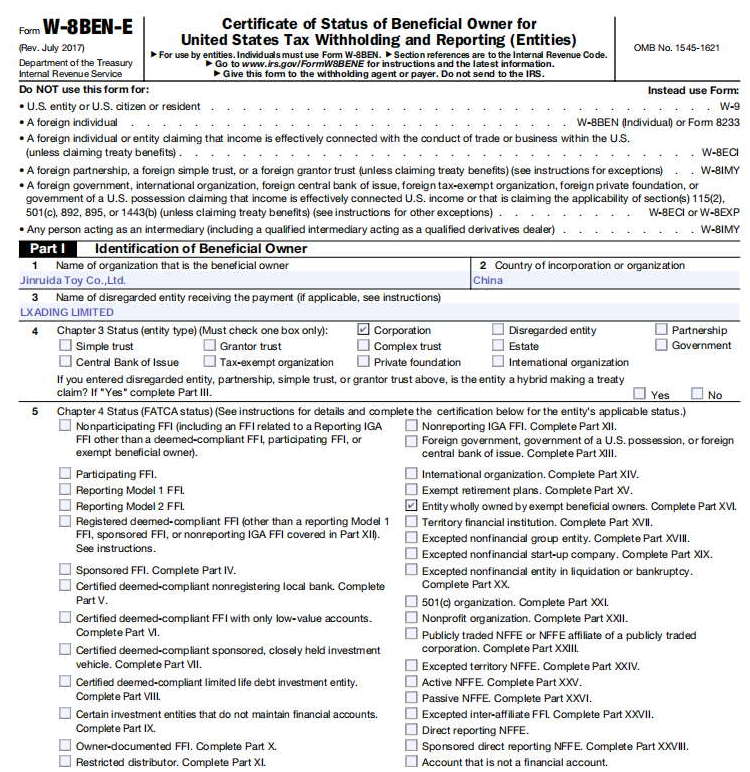

美国纳税W-8BEN-E到底要填哪几项?

老外原话说:没法教你怎么填,只能大概告诉你你这种公司要怎么填,This form is tricky and can be difficult to complete. I am unable to tell you exactly how your organization should complete the form. However, I can tell you what we typically see from similar companies and what we would expect to see on Zhenba Magicgo Co's Form W8-BEN-E.

注意①they need to print the form and complete it. W-8BEN-E is Invalid, the company is not an "Entity wholly owned by exempt beneficial owners." They are not a Foreign Financial Institution that is an investment entity. They are most likely an "Active NFFE"

注意②1. Part I, Line 5- Box for "Active NFFE" is typically checked instead of "entity wholly owned by exempt beneficial owners."

注意③. Part II can be left blank, since the company is most likely not a financial institution (such as a bank).

注意④. Part XVI, Line 30 Box should be unchecked

注意⑤. Part XXV, Box 39 should be checked

假如老外还是看不到字:打印出来,签字+写上日期,然后扫描件发给他

老外说我们发过去的都看不到,让我们打印出来,签字+写上日期,然后扫描件发给他。I suggest printing the form, signing and dating it again, and then scanning a copy to send via email. That should solve that problem.

W8-BEN-E最终模板参考

如何填写美国纳税表格W9或者W-8-BEN-E的样本如下,身份是中国公司+香港离岸收款

PDF如何签名?一定要打印出来吗?

Can you please sign the last page on the bottom left side and re-send?